22/08/2025

Globalization at a Crossroads: Reassessing Trump’s Tariffs, Financial Markets, and Fukuyama’s “End of History” Thesis

Assoc. Prof. Caner Özdurak presented his paper at the 14th International Conference on the Restructuring of the Global Economy (ROGE) at the University of Oxford, exploring the profound impact of protectionist trade policies implemented during Donald Trump’s presidency on global financial markets. The study also offers a critical reflection on Francis Fukuyama’s “End of History” thesis, which proclaimed the triumph of liberal democracy.

Key Findings and Analysis

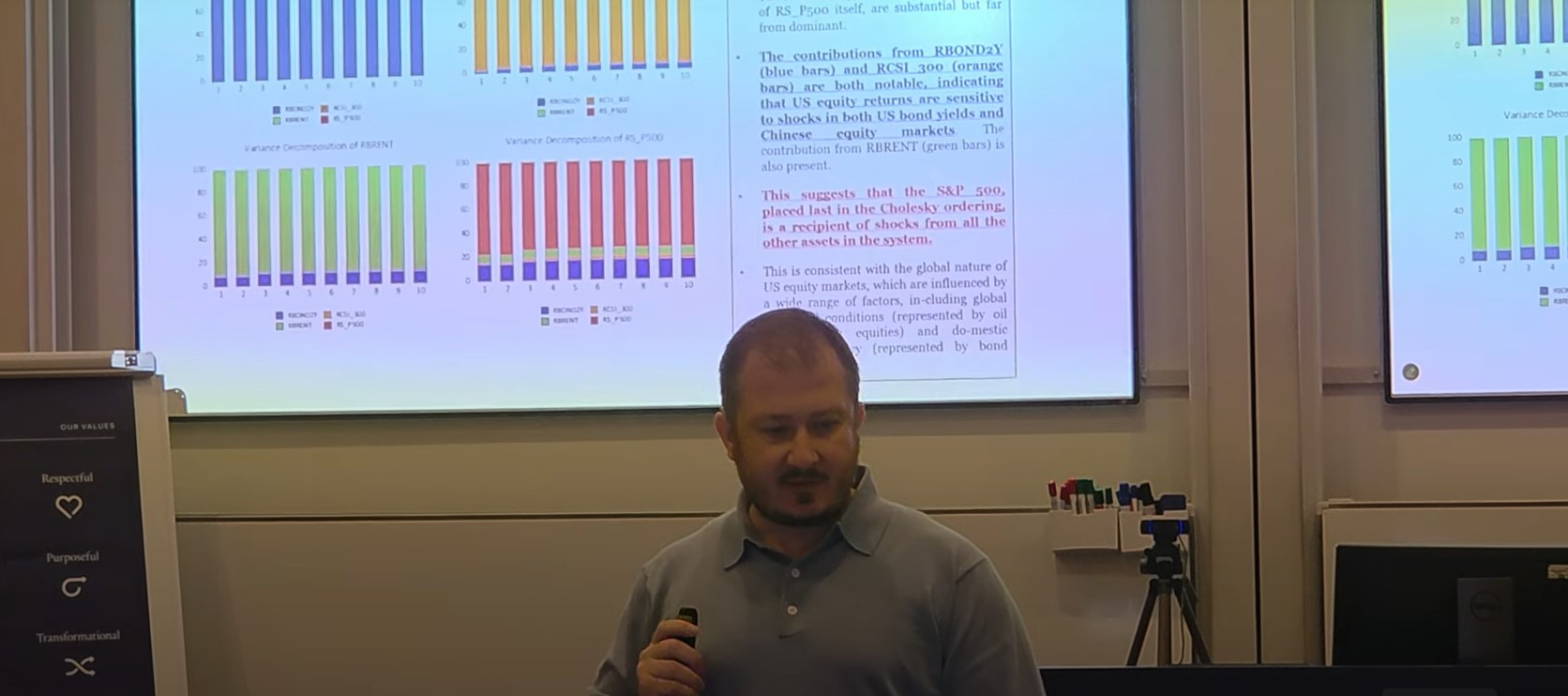

Dr. Özdurak’s research demonstrates that Trump’s tariff policies significantly increased market volatility and reshaped investor expectations. Using a Vector Autoregression (VAR) model, the study reveals that trade policy shocks affect different asset classes in distinct ways and account for a substantial portion of the S&P 500’s volatility during the examined period. These shocks operate by amplifying uncertainty about future economic growth and investor risk perception.

Market Volatility: Export-dependent firms were particularly vulnerable to trade-related shocks, experiencing heightened volatility in their stock valuations.

Inflation and Bond Yields: The imposition of tariffs raised inflationary concerns, triggering market responses such as higher bond yields.

Historical Context: The study underlines the historical link between trade disruptions and financial crises, emphasizing the potential implications of contemporary trade policies for financial stability.

Challenging Fukuyama’s Thesis

While Francis Fukuyama’s post–Cold War thesis heralded the ultimate victory of liberal democracy and free-market capitalism, Dr. Özdurak argues that Trump’s protectionist policies put this claim to a serious test. The paper provides empirical evidence showing that modern trade policies can undermine financial stability and threaten the assumed trajectory of globalization. The findings highlight how major macroeconomic decisions have profound micro-level implications, revealing that the financial stability promised by liberal democratic governance can be destabilized under the pressure of contemporary trade dynamics.